Australian Crop Update – Week 51

FOB replacement values using the Australian track bid/offer (AUD) – not a FOB Indication

Harvest and Weather Update

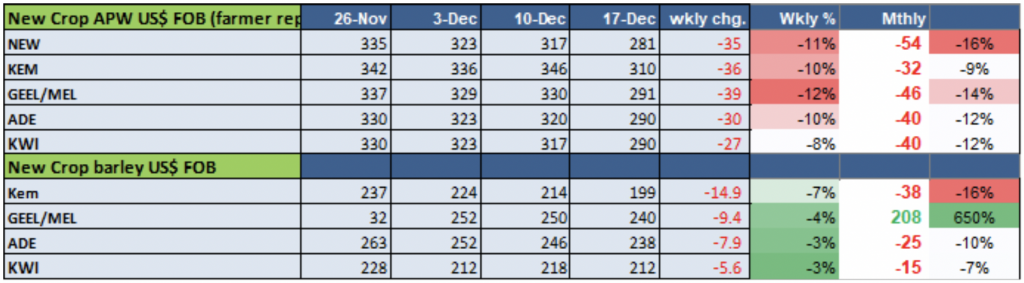

Domestic wheat prices tumbled last week as New South Wales feed wheat started to hit the market and dragged lower protein milling wheat with it. Traders also pulled back milling wheat bids sharply.

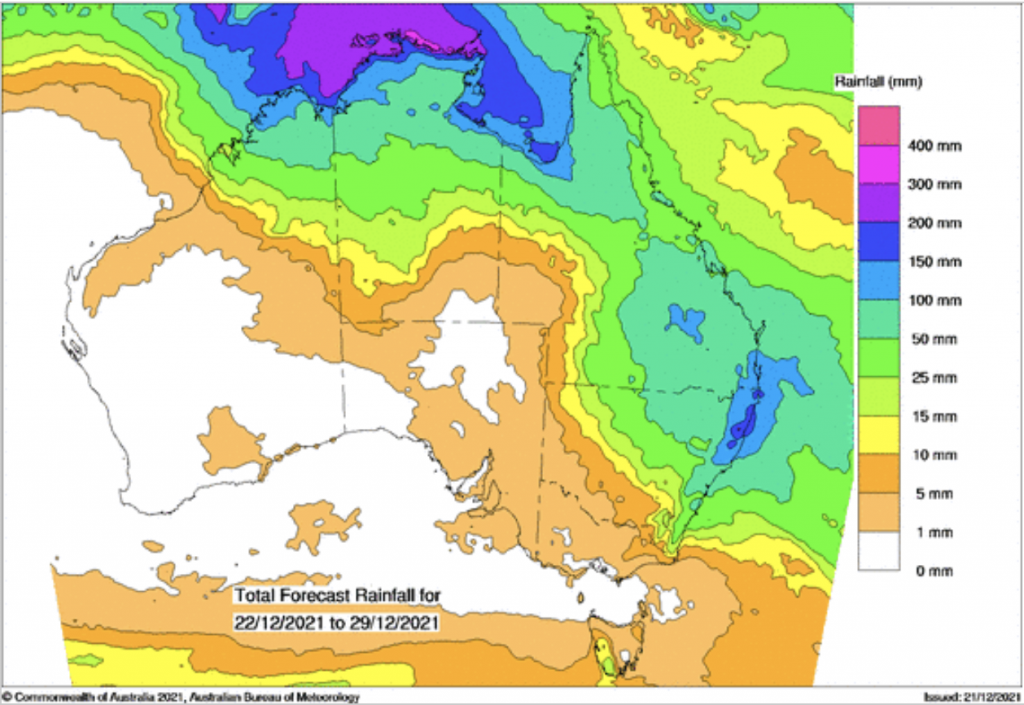

The weather has been kind and harvest has progressed strongly in most areas including most of New South Wales.

In talking with our analysts’, they feel wheat crops in Western Australia and New South Wales will now be larger than forecast prior to harvest and are estimating the crop moving through 35MMT mark, pushing towards 36MMT.

Victoria’s wheat quality is coming off slightly better than average, although the state only accounts for 12% of the national crop. At the same time, the harvest in the larger production states of Western Australia and New South Wales, which together account for more than 70% of the crop, remain dominated by low protein ASW in Western Australia and SFW/AH9 in New South Wales.

In the cash markets, exporters have been forced to cancel or shift milling wheat exports and are now scrambling to switch to feed wheat sales where they can. It seems that 2.5MMT plus of milling wheat and feed wheat has been sold to China. This is expected to include 1.5MMT to 2.0MMT of feed wheat.

We believe logistics constraints and quality will cap Australia’s capacity to export more milling wheat to fill the shortfall left by the flagged Russian export quota. The USDA is already forecasting Australian 2021/22 wheat exports at a record large 25.5MMT which is 7% more than last year. Quality problems means a significant proportion of Australia’s wheat exports can’t be readily used by traditional markets and as such, a significant proportion of the export task will be low protein and feed wheat and this need to be borne in mind when consulting the global balance sheets.

Advanced EU wheat exports together with the small Russian wheat exports will, in our view, create some volatility in Q1 and Q2 of next year as the market starts to refocus on the northern hemisphere new crop where there are already some production flags emerging in North America particularly.

Australian barley remains competitive into most export homes but the bids to the growers are not attractive, and it is struggling to pull stem away from canola, wheat, and feed wheat. For the time being, the barley market seems to be trading around Australia, although there was some talk of Mexico showing interest in malt barley earlier this week.

Ocean Freight

The market was very quiet as it seems a lot of market participants have already squared up their positions ahead of the Christmas holidays.

Currency – AUD

We expect the AUD will remain range-bound through the holiday season, fluctuating between support at 0.70 and resistance at 0.7230. Risks to this outlook remain the evolving Omicron situation.

This will be the last report of 2021 and we would like to use this occasion to wish all our customers, partners and suppliers a healthy and happy festive break – if you are taking one. We hope that 2022 will be a fantastic year for you and your families.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 51 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.