Australian Crop Update – Week 50

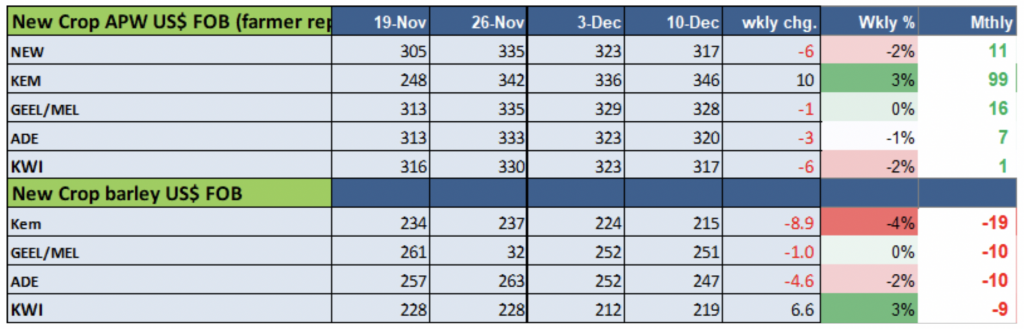

FOB replacement values using the Australian track bid/offer (AUD) – not a FOB Indication

Harvest and Weather Update

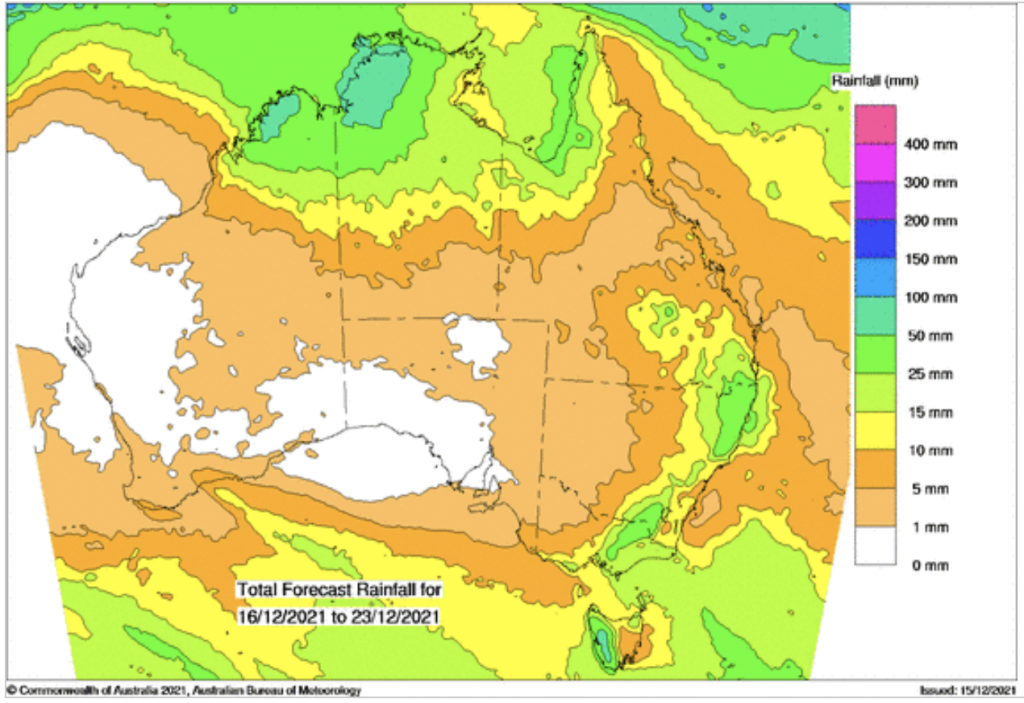

Last week was a volatile one for the Australian markets. Local cash values were trading the scarcity of quality milling wheat supplies and have remained relatively stable. Although, in the last couple of days we are starting to see feed wheat values, and interestingly, high protein values come under pressure.

Buyers are pulling east coast wheat and barley values as farmers start to release weather spoiled crops onto the market, while bids in Western Australia and South Australia are better supported as exporters chase supplies against shipping commitments.

Harvest is progressing quickly in most states, approaching 70% complete, with record receivals are being recorded in WA. The strong deliveries flag the potential for a further production number increase.

In respect of harvest quality, in NSW there are only a few areas where the wheat falling numbers are coming in above 200 and plenty where they are coming in sub 150. The test weights have held up well and farmers are still reporting high yields. Victorian quality has been good, with a reasonable volume of hard wheat ranging between 11.5% to 13% protein and APW now hitting the bin. South Australia is seeing a similar profile. Western Australia continues to have a crop profile dominated by ASW and low protein wheat.

Ocean Freight

It has been an uninspiring week in the freight markets. The Atlantic pushed up in the early part of this week with the Pacific market quietly following suit. Rates in Asia firmed for Handysize, Supramax and Ultramax, while Panamax has stalled a bit

It is hard to tell whether the firmness we are seeing this week is related to cargo interests fixing early, prior to the impending festive break, or whether there is a more fundamental movement of the cargo supply and demand equation. Time will tell. It feels like a lot of market participants are taking the opportunity to travel over the festive break and certainly, the market has an “end of the year” feel to it.

Currency – AUD

The Australian dollar fell through trade on Monday, unable to sustain Friday’s risk on move as fears surrounding the impacts of omicron and positioning ahead of this week’s key US Federal policy update.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update – Week 50 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.