GrainCOM 2022 – Geneva 17-19 May

With in-person industry events back on the cards, it was the promise of a conference committed to looking forward and to addressing a range of topics important to the industry currently that saw our Chris Whitwell on a plane to Geneva for GrainCOM 2022.

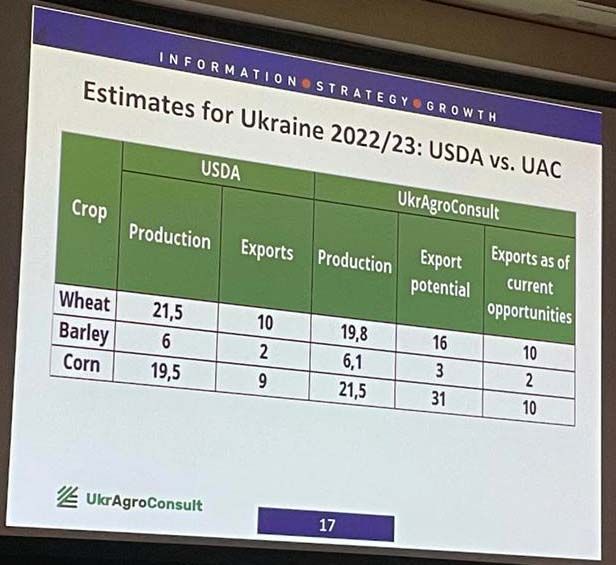

As you would expect, a key focus was the impact the Russian and Ukraine war is having on grain around the world and the flow-on effects we’ll see from this medium to long term. It was humbling and enlightening to hear the efforts being made by Ukraine to export what remains of the 2021/22 crop. What stood out for Chris was the feeling it is likely to get harder, not easier, as logistics start to be diverted into moving the European crop, and fuel, fertiliser and storage shortages start to impact the ability to grow, harvest and store the new crop, and beyond that, plant the 2023 winter crop.

Outside the Black Sea sessions, the general theme was one of production concerns and logistics challenges in all major producing countries along with a global weather outlook that has many “hot spots” that may provide further volatility to an already tight grains and oilseeds outlook as the way things stand currently. There was much discussion about what could be, and maybe done by various bodies, to bring more of the Black Sea production back into this and next year’s trade-flows, but in Chris’s view, the level of optimism about what may be achieved is not being matched by the realities and progress at ground level.

From a demand perspective, the level of demand destruction to be expected from high prices was debated and the conclusion that this will be region-specific with sub Saharan African and parts of Asia particularly hard hit resounding for those participants who are interacting with those markets day in and day out. Many of these economies were badly hit by COVID and their populations were not supported by stimulus cheques. As a consequence, they are struggling to live with grain prices that have doubled in the last eighteen months. It is very likely that the balance sheets will see demand shifting to more local substitutes such as plantains and rice.

Although it was difficult to be positive in a market that is facing such challenges and the potential for even greater volatility, there is always an upside. “This too shall pass” and it was great from a personal point of view to catch up with old friends after such a long time “locked down“ in Australia and I would like to add my thanks to the organisers who put on the conference. Geneva put on some great weather for those of us who have been living with record rains on the Eastern Seaboard of Australia.

For more information on Basis Commodities and how we can assist your business to manage the current pressures being placed on logistics throughout the country, send the team an email at info@basiscommodities.com.

If you would like to receive regular market information from Basis Commodities, be sure to sign up to our weekly market reports below.

The post GrainCOM 2022 – Geneva 17-19 May appeared first on Basis Commodities.

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.

Newsletter Signup

Thank you for signing up to the Basis Commodities email newsletter.

Please try again later

Quick Links

Basis Commodities Pty Ltd

PO Box 340, Northbridge

NSW 1560, Australia

Basis Commodities Consulting DMCC

PO Box 488112

Dubai, UAE

Copyright © 2024 Basis Commodities Pty Ltd. All rights reserved.

site by mulcahymarketing.com.au