Basis Commodities – Australian Crop Update – Week 7, 2023

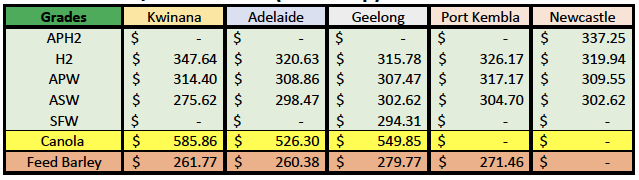

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

Australian Market Review

Australian domestic markets were firmer in most areas on domestic and exporter short covering. The choppy price patterns continue as buyers push values higher at the regional level on short covering before pulling bids back when square.

Wheat and barley both strengthened last week. Barley values were firmer with exporters hopeful the meeting between Australia and China’s trade ministers may lead to China ending its unofficial ban on Australian imports. Comments following the meeting were encouraging but also flagged no immediate changes and that progress may take time.

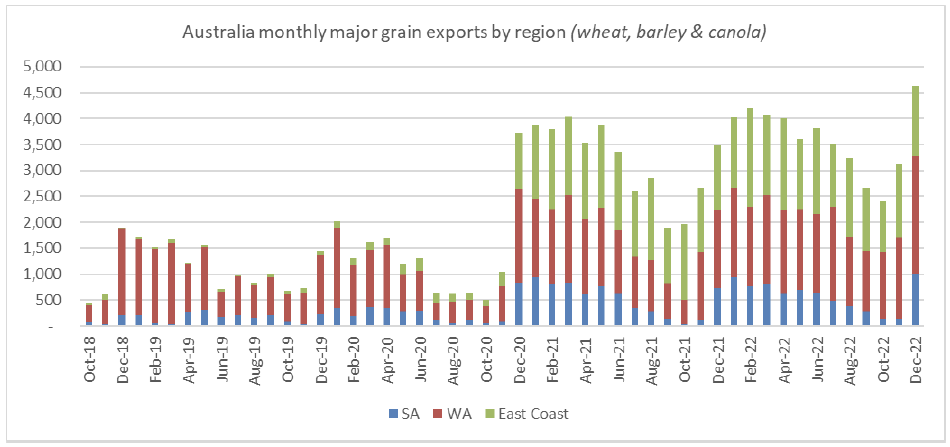

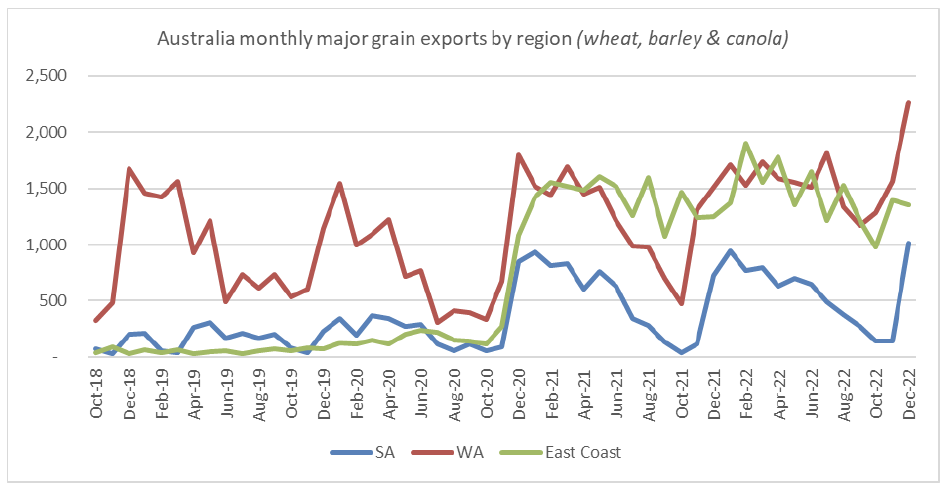

Australian Export Data (ABS) to end December

Australia exported 2.667MMT of wheat, 1.08MMT of barley and 0.884MMT of canola in December. The combined monthly wheat, barley and canola exports for December were 4.635MMT which is 550KMT more than last year’s monthly high set in March 2022.

Wheat:

China accounted for 859KMT of the December wheat exports. Indonesia was the next largest with 381KMT followed by South Korea with 299KMT, then the Philippines with 294KMT and Vietnam taking 177KMT. Australia has shipped 1.65MMT of wheat to China in the first quarter of the new marketing year.

Barley:

There was 535KMT of barley exported to Saudi in December. Japan was the next largest with 178KMT. Interestingly a panamax also went to Iran.

Sorghum:

Exports fell to 48KMT from 107KMT in November with China accounting for most of this.

Canola:

Most of the 884KMT canola exports in December went to Europe. Other notables were 117KMT to Pakistan and 65KMT to the UAE.

Shipping Stem & Ocean Freight

It’s been a busy week for shipping stem additions in Australia with 1.4MMT of wheat, barley, canola and lentils put added in the past week. This included nearly 1.1MMT of wheat, 284KMT of barley and 48KMT of canola. Most of the vessels added were for March shipment.

The freight market had a sense of “same again” last week but we feel there is definitely a slow burn on sentiment that hasn’t quite reached the critical point yet. Tonnage lists are slowly tightening – especially in the Pacific and charterers are quietly hedging their bets by fixing forward off market. It remains the case that owners want premiums to fix business more than two weeks forward but likewise they are quick to drop their rates when they have a ship to fix in the next 7-10 days. Optimism on the forwards but pragmatism on the nearby. The FFA market has been very up and down but the premiums for forward are consistent. Owners have kept their nerve for period tonnage and are holding out for numbers that reflect a strong premium over todays rates ($14kpd for 1yr tc on 38kdwt vs $9.5kpd on pac rv….). For those keen to take periods – and there are numerous operators looking for physical cover at the moment – indexated deals seem to be in vogue so they are sacrificing the potential forward profits in order not to take too big a hit up-front.

Pulses

Lentil exports were 166KMT in December. India took 87KMT, Bangladesh 36KMT and then the UAE with 24KMT. Chickpea exports for December were 70KMT with 37KMT of this shipped to Bangladesh and 20KMT to Pakistan. Faba bean exports in December were 24KMT.

Jumps in export figures for all pulses reflect new-crop availability and compressed early shipment demand created by a harvest that was slow to start and rain-delayed.

Currency

The Reserve Bank of Australia has increased rates for the first time in 2023, by an expected 25 basis points (0.25%) to 3.35%. This is the highest level of interest rates since 2012. The AUD is currently sitting just under .70 US cents.

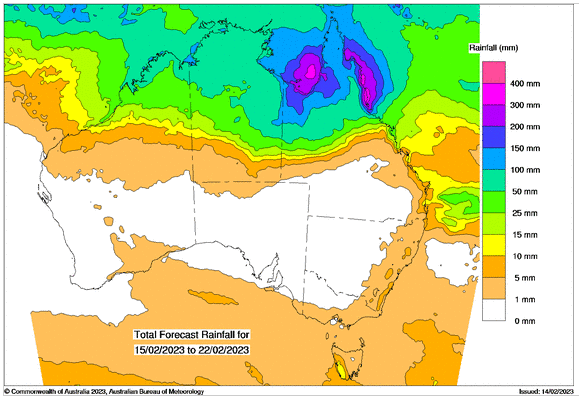

Australian Weather

Source: http://www.bom.gov.au/

Source: http://www.bom.gov.au/

The post Basis Commodities – Australian Crop Update – Week 7, 2023 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.