Basis Commodities – Australian Crop Update – Week 49

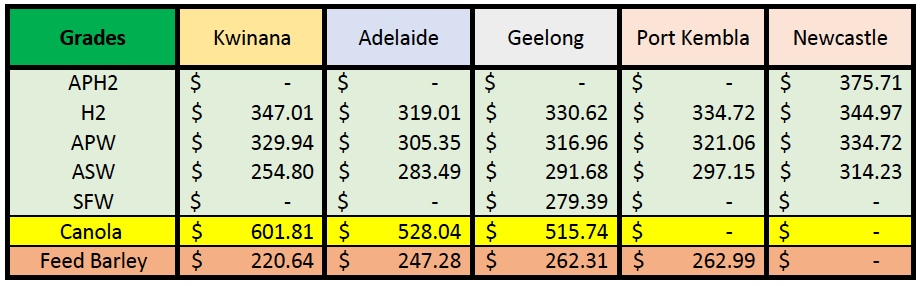

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

We have had another good week of harvest progress this week. Queensland wheat harvest is now more than 80% complete, New South Wales is approaching 33% complete while Victoria is less than 20%. The reported grain quality remains highly variable ranging from milling grades as well as downgraded quality. In truth, we have been surprised at how well the wheat crops in the east have handled the rain in October and November and the volume of the crop that is making milling quality.

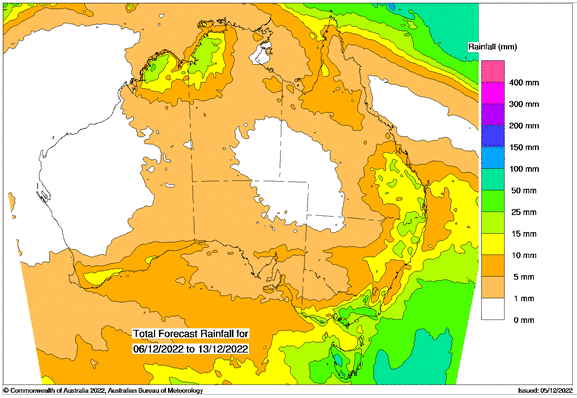

That said we are expecting the quality profile of the NSW crop to decline as harvest moves south into the regions that were more significantly impacted by the general 50-70mm in mid-Nov. This was the rain event that dumped 50-100mm across parts of the Central West which is still draining. We are hearing that SFW and GP is the major grade in the western Riverina for instance.

In Western Australia, CBH received 3.4MMT of grain in the week to Sunday 4th December up from 3.0MMT in the previous week. We estimate the Geraldton zone is about 66% complete, Kwinana 50%, Albany 33% and Esperance about 40%. Yields are very good and are supporting a similar crop profile to last year with ASW being the dominant wheat grade. No matter how much fertiliser farmers apply, record wheat yields mean low protein content.

As harvest has progressed and the global market weakened, both futures and cash values have been on the back foot. Local markets were a sea of red. Nothing was immune from the sharp declines, with wheat, barley, and canola particularly, on the east coast and in South Australia. ASX wheat fell $24 (5.5%) for the week to $399.50.

The other notable for Western Australia was the floor in feed barley bids disappeared. Kwinana feed barley bids were off 10% for the week which is the same as SA.

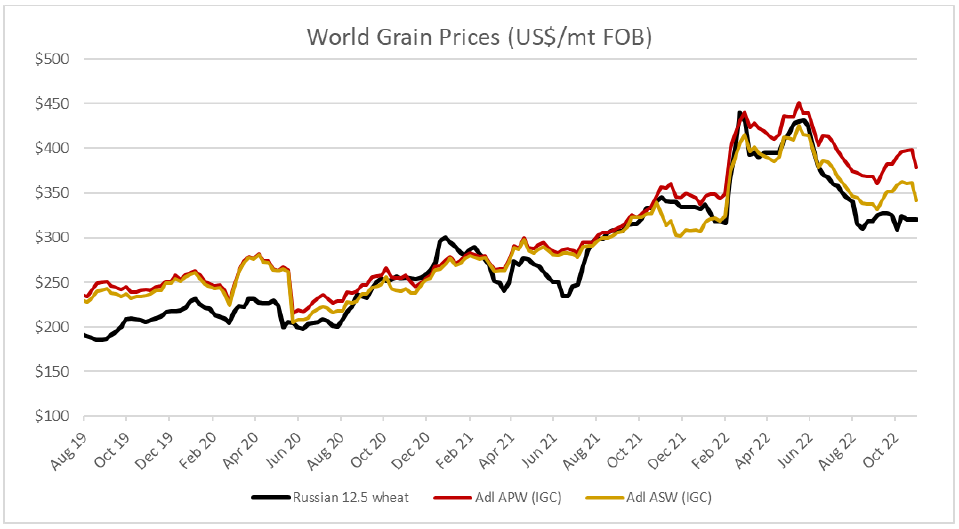

So where to from here? Our analysts put these charts together based on IGC export quotes for just Australian APW, ASW and Russian 12.5 pro wheat.

Australian wheat export quotes (ASW and APW) fell sharply with the declines in US futures helped by the first week of decent harvest progress. Russian wheat prices have been steady over the past few weeks with the quotes nominally holding between the $317-320 FOB range. The function of the market will be to maximise Russian wheat exports and then push more volume into Africa and Asia as more traditional homes are exhausted. Lower ocean freight only encourages this process and this in turn puts more pressure on the price premiums for non-Russian wheat, including Australian. The issue however remains access to logistics and at the risk of repeating ourselves, this is what we are trading. We have just finished a tour through Western and South Australia and the sense we get still is that logistics are tight through to March at least.

From a flat price perspective, what happens to global wheat prices going forward is largely going to be a function of what happens to Russian wheat prices. We see demand largely remaining spot. Russian values should remain well supported particularly if the winter has a negative effect on their ability to ship. Global values will then look at the prospects of the 23/24 northern hemisphere crops as they start to come out of dormancy in March.

ABARES Crop Report & Agscienta Balance Sheet Updates

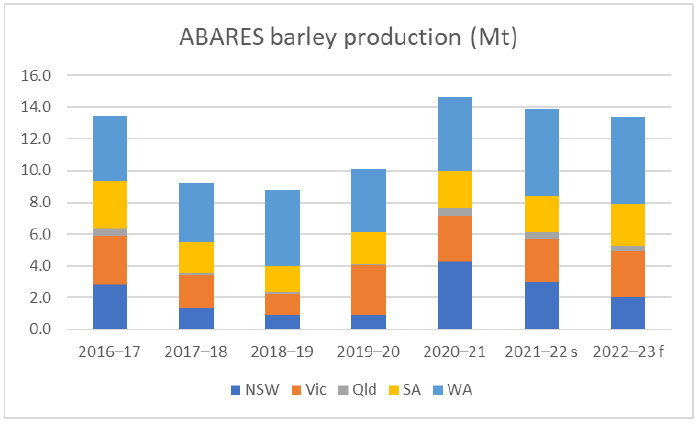

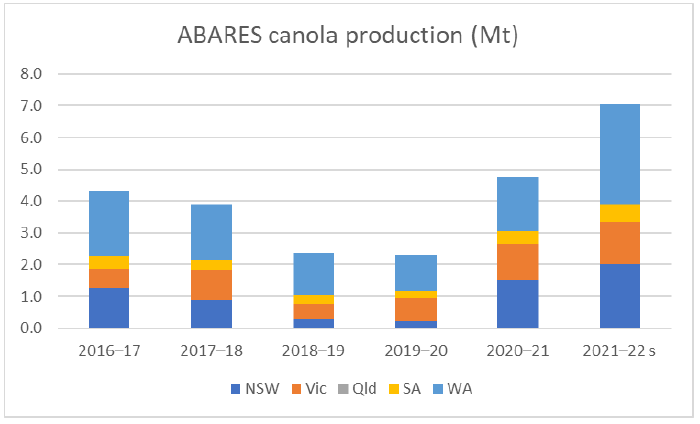

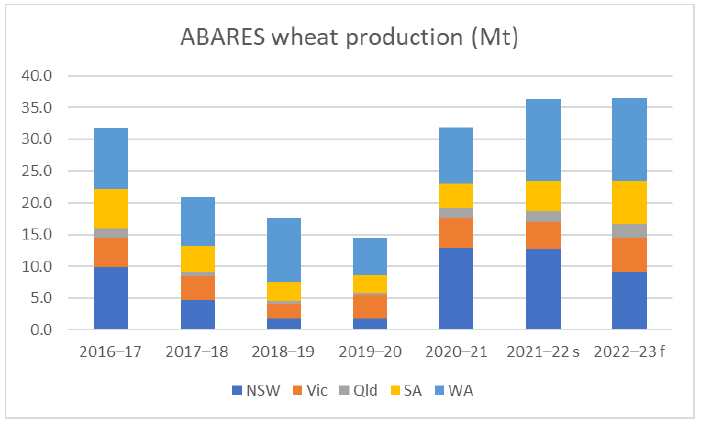

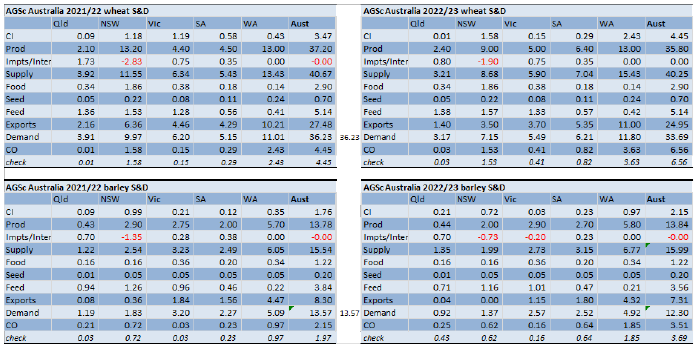

ABARES has released its December crop report which projected a national winter crop production of 62MMT in 2022-23. Production is expected to reach new records in Western Australia and South Australia following favourable spring conditions in these states. Crop prospects in the eastern states remain high overall including forecasts of record production in Victoria, but widespread losses are estimated in regions affected by untimely record spring rainfall. Crop abandonment in the eastern states due to flooding and extreme rainfall over spring is estimated to total around 16% of planted area in New South Wales, 7% in Victoria and 5% in Queensland. These abandonments are factored into ABARES forecasts through lower state-wide average crop yields, which are calculated on area planted rather than area harvested. Wheat production was forecast at 36.6MMT up from last year’s 36.3MMT. Barley production was forecast at 13.4MMT, slightly lower than last year’s 13.9MMT. Canola production was projected at 7.3MMT up from 7.0MMT last year.

ABARES also expects that flooded and otherwise too‑soggy areas will see declines in wheat quality. So, as most expected, there is likely to be considerably more feed‑grade wheat available from this crop. Also, largely unexpectedly, the drop in milling‑grade wheat supply is likely to be modest.

Pulses

The northern Fava Bean crop is still being harvested with predominantly 2s and 3s seen so far. The Victorian crop has all but been consigned to feed and the SA crop is still a few weeks away from harvest with concern growing about its quality and ability to withstand another rain event.

Lentils seem to have held quality better, being earlier, but there are still some quality issues that need to be managed through carefully. There is little to no farmer selling and the exporters show little or no inclination to get in front of the grower and sell FOB. So for the time being the market watches and waits.

Ocean Freight

The ocean freight market continues to idle along with negative sentiment in the ascendancy for now. For the bulls there are slim pickings. The script runs something along the lines of an early Chinese New Year suppressing market activity until the end of January, then in February, the Chinese authorities will release COVID restrictions and simultaneously stimulate the domestic economy. Commodities will be fashionable again to coincide with greater imports and all will be well. Returning to the present, the most interesting issue is bunkers. They had slipped, but now seem to be heading up again due to the price limitation on Russian oil.

Currency

Uncertainty is in the air, and everyone is feeling the pressure of the days ahead.

At the beginning of the week, Australia released the retail sales data with an unexpected decline of -0.2% vs 0.5% expected. That is making more pressure on the AUD/USD which has weakened -by 0.84% during the week so far. The RBA increased the cash rate by 25bps and the AUD traded sideways. The USD GDP print is expected tomorrow.

The post Basis Commodities – Australian Crop Update – Week 49 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.