Basis Commodities – Australian Crop Update – Week 44 2022

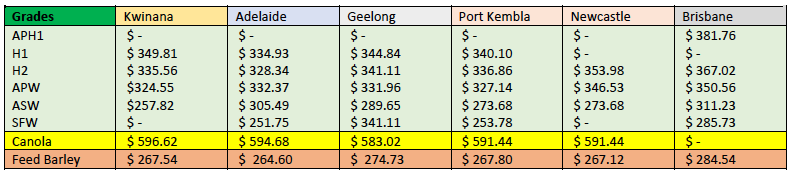

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

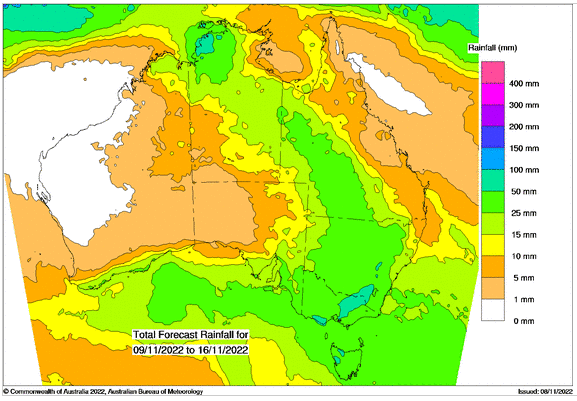

Australian cash markets continued to strengthen last week as east coast wet weather flushed out shorts. Storms early in the week kept everything wet, further complicating the already difficult situation with grain logistics and tight nearby supplies. There was another 30-50mm of rain across Queensland cropping areas, 20-50mm across New South Wales and 10-15mm across Victoria. Weather improved in the later part of the week, but the damage was done by the earlier storms and many areas are now experiencing flooding.

Western Australian cash values were also higher which looked to be driven by nearby export shorts. Quality spreads are widening which is reasonable given how the weather is affecting a lot of the higher protein areas. The Kwinana APW1 / ASW discount is also large with traders expecting another big ASW year.

In terms of harvest pace, Graincorp has received 330KMT of grain deliveries to date, the bulk of this in Queensland. Viterra has received a trickle of wheat in South Australia, and it will be another 1-2 weeks before harvest pace picks up there. CBH has received close to 1.3MMT of grain deliveries which would represent about 2% of the expected 24MMT plus of deliveries. Early harvesting in Western Australia has been mostly canola. Australia’s wheat harvesting is less than 1% complete.

Eastern Australia is forecast to see a drier and warmer week ahead before further rain is predicted on the eight-day forecast. Cooler temperatures and wide planting windows mean the bulk of the crop is still green, so hopefully if the rain keeps away we will still have some good news to share in the coming weeks from a quality perspective.

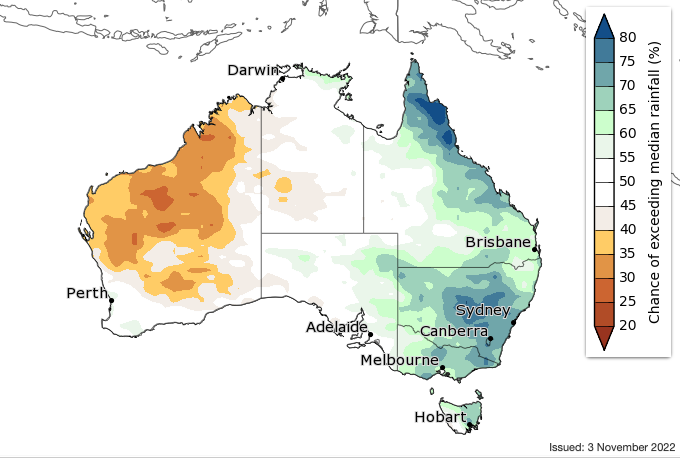

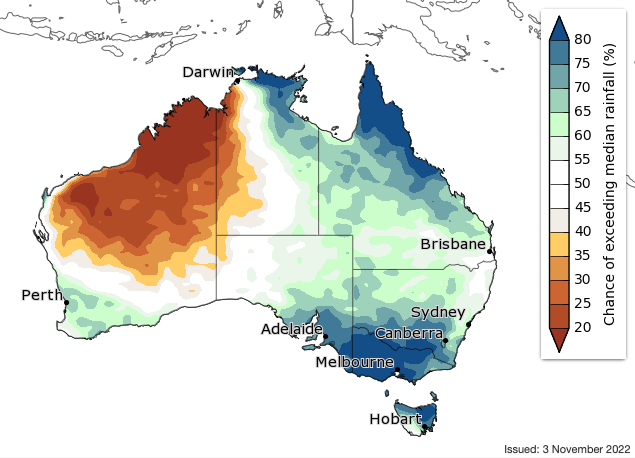

On the other hand, the Bureau of Meteorology expects the wetter than normal east coast pattern to continue through November and December, but Western Australia and South Australia are not expected to be as wet. The combination of La Nina, negative Indian Ocean Dipole (IOD) and warmer than normal ocean temperatures around Australia are driving the wetter than normal patterns across much of Australia, the Bureau said.

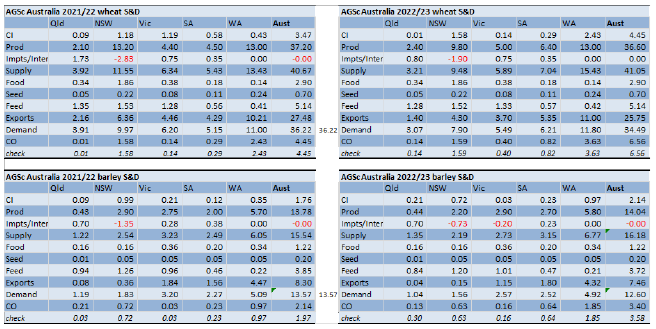

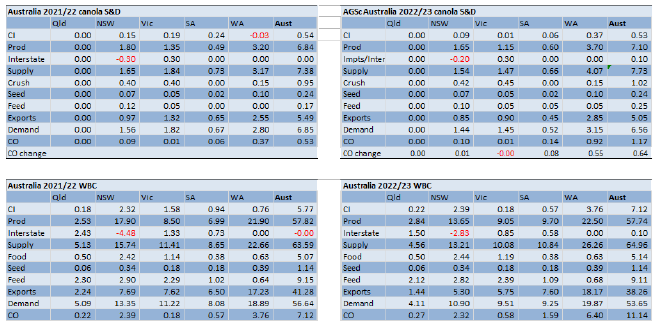

Australian Supply & Demand Balance Sheet Update

Our analysts closed out the 2021/22 marketing year with Australia exporting 27.5MMT of wheat, 8.3MMT of barley and 5.5MMT of canola. WA accounted for 17.2MMT of this, NSW 7.7MMT, Vic 7.6MMT, SA 6.5MMT and Qld with 2.2MMT. This has left Australia’s 2021/22 ending stocks at 4.5MMT of wheat, barley stocks at 2.1MMT and canola at 0.5MMT. WA and NSW account for the bulk of the carryover stocks. Another similar size winter crop in 2022/23 will see further stock builds in WA this year.

AgScientia made an adjustment to the 2022/23 forecast reducing NSW wheat and canola crops 9.8MMT and 1.65MMT respectively, with further reductions expected in the coming week. WA barley and canola production has been lifted to 5.8MMT and 3.7MMT respectively.

Wheat protein will be lower than normal and likely to contain a big proportion of feed wheat quality on the east coast. With a restricted summer crop due to poor planting conditions for sorghum and cottonseed, this proportion of feed wheat will be welcomed. It is estimated at least 4MMT of the Qld/NSW/Vic wheat crop will be feed wheat (SFW) but this could easily be surpassed with more unseasonal rain through November and December and a long tail to the harvest forecast.

The smaller NSW wheat crop and larger Vic/SA harvest will alter the configuration of Australia’s wheat export surplus in 2022/23. NSW wheat exports are forecast to fall to 4.3MMT, down 2.0MMT from 2021/22. Vic exports will be similar while SA exports are expected to rise slightly. The national export forecast is 25.7MMT (27.5MMT last year) for wheat, barley exports are estimated at 7.5MMT (8.3MMT last year) and canola exports at 5.0MMT.

Export Stem & Ocean Freight

Wet weather continues to stall east coast export activity while the focus remains on canola in Western Australia. There was 445KMT of wheat added to the stem over the past week, 209KMT of barley and 140KMT of canola.

The freight market remains in a state of flux. Spot numbers dropped quickly last week after owners realised early the market was extremely weak in Asia. Notably, there are relatively few coal requirements in the region – and more particularly for China. Periodically China turns off the tap on various commodities for whatever reason, and it feels like this is one of those times. Combine that with a general easing of congestion in the region, ongoing geo-political uncertainty and market confidence evaporates. Tonnage lists are long for Supramax and Handysize vessels and it’s difficult to see where the support is going to come from.

Australian Dollar

In FX markets, the AUD fell around 1% early on Monday, quickly reaching an intraday low of 0.6402, but has since recovered to be up 0.2% at 0.6480.

The post Basis Commodities – Australian Crop Update – Week 44 2022 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.