Basis Commodities – Australian Crop Update – Week 45 2022

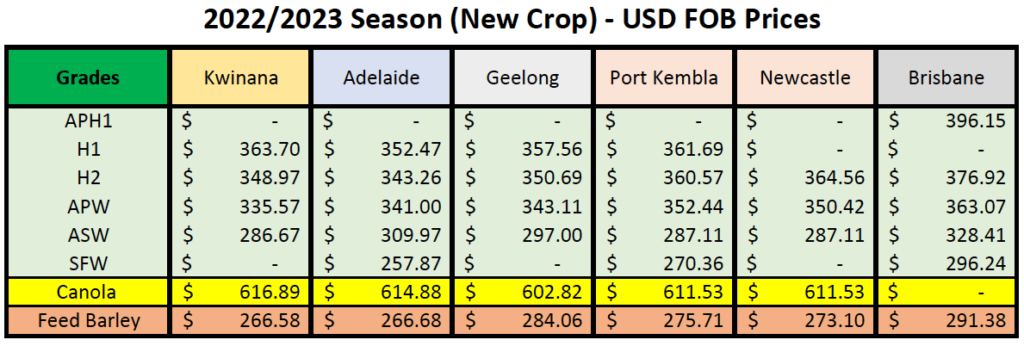

2022/2023 Season (New Crop) – USD FOB

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

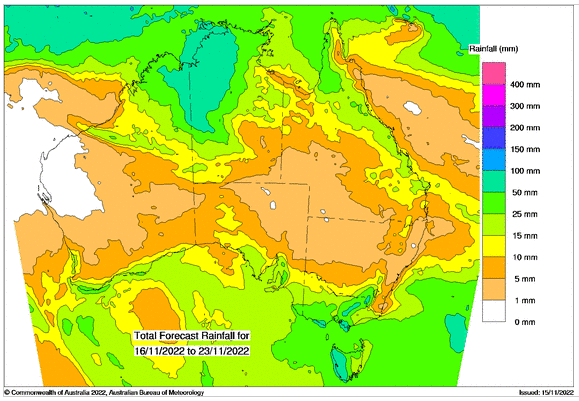

orrential weekend rain across New South Wales and parts of Victoria and South Australia is expected to result in quality downgrades. NSW copped the worst of the rain with 40-70mm across most areas and upwards of 100mm in some parts including Forbes and Cowra. The positive for NSW was the rain didn’t go as far north as Moree and into southern Queensland. The Victorian Mallee / Wimmera also received heavy falls on Saturday amounting to 30-50mm. The SA Murray Mallee received heavy rain, but it was lighter on the Eyre Peninsula. Western Australia continues to escape the deluge.

We believe Queensland harvest is 40% complete, all of NSW around 10% and Vic/SA less than 2%.

Weather forecasts are drier for the next two weeks at least, although December still looks to be on course for above average rainfall and critically, supply chains are still disrupted by widespread flooding which is slowing harvest logistics.

However, enough harvest is now underway to allow the cash markets in Australia to begin to work again.

The track quality premiums are starting to work as well as harvest progresses, giving buyers and analysts a better understanding of how the early harvest quality is coming off. APH was up A$13/MT for the week, H2 down A$4/MT, APW up A$4/MT and GP/SFW down A$2/MT. Anecdotal reports from the north indicated there is some H2 coming off but not much APH and plenty of APW, ASW and GP/SFW.

Harvest is progressing well in Western Australia, and this is putting pressure on prices which were broadly softer. Most receivals are in the Geraldton and northern Kwinana zone and about 70% of this was canola and around 15% each of barley and wheat. Early indications are the wheat proteins are slightly up on last year where the crop was dominated by a lot of low protein ASW, but care needs to be taken reading anything into such a small sample size, particularly as Geraldton is normally a better performer in the protein stakes. Canola prices were lower in all states.

Balance Sheet Update

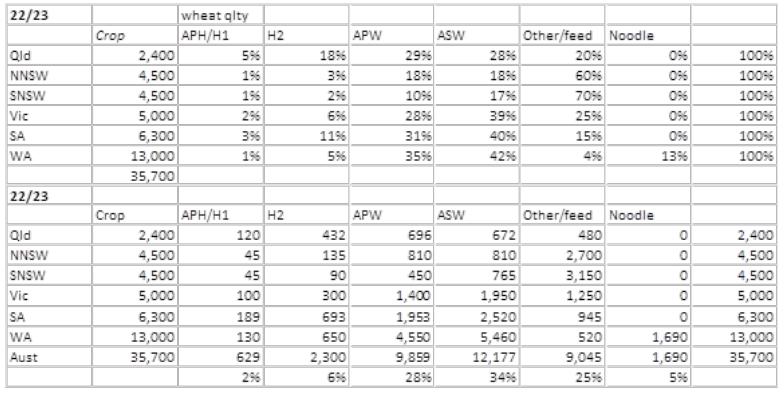

We have pulled back our forecast of NSW wheat production by 0.8MMT to 9.0MMT on the back of flooding in the northern cropping areas around Moree and to the west. We have assumed that about 100k ha of wheat in the region will not be harvested due to the flooding, and our analyst’s national wheat total is now 35.7MMT.

We have also lowered the barley harvested area by a similar percentage at the regional level by 400KMT to 2.0MMT compared to last year’s 2.9MMT. Our analyst’s national barley total is 13.8MMT.

AOF pegged the Australian canola crop at 6.75MMT. The most notable of the state forecasts was NSW at 1.25MMT down from last year’s 1.8MMT despite a forecast 12% increase in the planted area. This implies state-wide canola yields at 1.35 t/ha down from last year’s 2.25 t/ha a 40% decrease.

Projected Wheat Crop Profile

Export Capacity and Ocean Freight

Just under 1MMT of grain was added to the stem last week. This included 594KMT of wheat, 274KMT of barley and 110KMT of canola. About 300KMT of wheat was added in Western Australia and 130KMT in NSW. WA accounted for 185KMT of the barley additions for the week with the rest in SA. All the canola was WA.

It was an interesting week on the freight markets. The underlying tone was weaker but there was also a risk off feel to the market. Asia continues to be weak but Handies and Panamaxes have stabilised. Supramax has continued to be weak. Chinese imports of Nickel ore are over for the season and imports of coal from Indonesia are very weak. China periodically shuts its doors to imports for varying reasons (and through various mechanisms…customs quotas, credit restrictions included) and the market invariably reacts quickly and negatively.

USDA Report Summary

The USDA’s November WASDE report didn’t offer any major surprises but that didn’t stop wheat finishing solidly lower. Wheat was off ahead of the release of the USDA’s report, and it continued following its release. USDA edged the US corn and soybean yields higher. The modest production increases were offset by slightly larger US domestic disappearance. This keeps US soybean and corn 2022/23 balance sheets tight and calendar spreads are reflecting that. It also re-enforces the importance of South American weather in the coming months. USDA raised wheat production in Australia and cut Argentina. Both were expected.

As a general observation, wheat has been trading demand for some time now and we expect this pattern to continue until a new flag emerges. Wheat has been sold down on the big flat price spreads for US wheat above other origins and most buyers are chasing cheaper Black Sea wheat. Global ending stocks were little changed at 267.8MMT which is 8.5MMT down on 2021/22.

Australian Dollar

In FX markets the AUD finished Friday at 0.6703.

The post Basis Commodities – Australian Crop Update – Week 45 2022 appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.