Australian Crop Update – Week 16, 2024

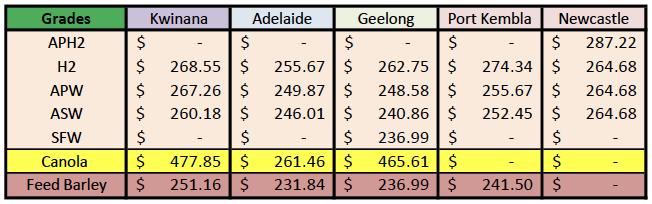

2024 Current Season – USD FOB Indications

NEW CROP PRICES ARE BASED ON TRACK BID/OFFER SPREAD PLUS ACCUMULATION & FOBBING COSTS AND ARE NOT FOB PRICE INDICATIONS.

New Crop - CFR Container Indications PMT

Please note that we are still able to support you with container quotes. However, with the current Red Sea situation, container lines are changing prices often and in some cases, not quoting. Similarly with Ocean Freight we are still working through the ramifications of recent developments on flows within the region – please bear with us.

Please contact Steven Foote on steven@basiscommodities.com for specific quotes that we can work on a spot basis with the supporting container freight.

Australian Grains Market Update

As we approach ANZAC day, which is traditionally seen as a time when Australian farmers get out into the paddocks and start planting next seasons crop, the east coast has plentiful soil moisture, South Australia (SA) has plentiful sub soil moisture but limited topsoil moisture, but Western Australia (WA) is dry and still waiting for seasonal break.

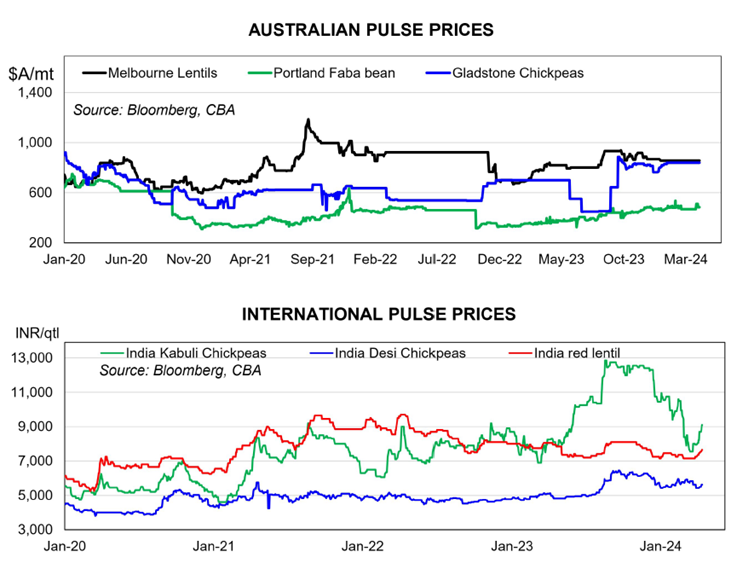

In terms of the cash market, the last week saw markets firm across all port zones on thin farmer selling. This was seen in pulses more than cereals. Victorian (VIC) lentil bids are $50-60 per metric tonne (/MT) higher in recent weeks.. Export grade faba beans are also $40-50/MT higher over the same period. Cereals were steady to firmer, with the extent of nearby shorts being the major determinant of the gains. Further declines in the AUD, which finished the week down nearly 1% against the USD, offered some support. In short, markets are fickle with the nearby needs dictating most of the price activity.

Australian Pulses Update:

In discussions with market participants, we sense it is becoming difficult to gather faba beans from the growers in Australia as liquidity in the market is extremely low. ABARES estimates the most recent Australian faba bean harvest yielded 528,000 metric tonne (MT), and something similar is unofficially expected from the upcoming season.

Considerable amounts of lentils remain in grower hands. Tightening Canadian stock is allowing Australia to price into the subcontinent despite a firming local price. ABARES estimates Australia’s current lentil crop at 1.4 million metric tonne (MMT), and unofficial estimates say the crop about to planted should be able to equal that.

India's total pulse imports remained very strong according to market commentary. Continued strong imports bode well for the prospect of a possible removal of the 44% duty on Australian chickpeas. Indian stocks of pulses are thinning due to government procurement campaigns. The import of duty free yellow peas has helped India limit local insufficiencies. Expectations are rising for the government to extend its duty free policy further indicating strong continued pulse demand.

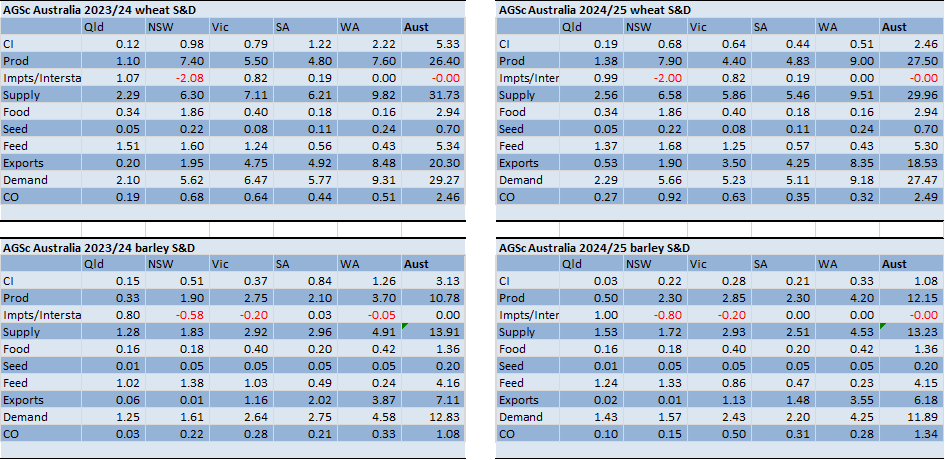

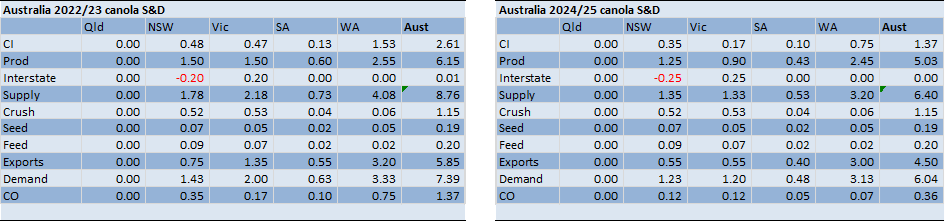

2024 / 25 Crop Forecast (Agscienta) & Supply & Demand Sheets:

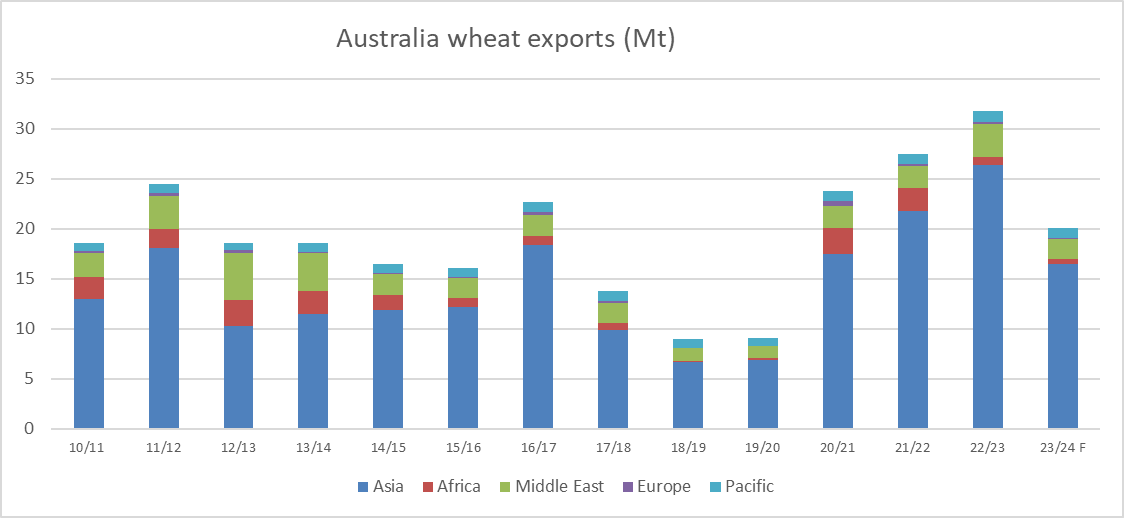

According to our analyst, the 2024/25 winter crop production estimates and balance sheets have been issued during the week with forecasts showing the 2024/25 Australian wheat crop at 27.5 (MMT), barley at 12.1MMT and canola at 5.0MMT. Overall, the Australian winter crop area is expected to be little changed on last year. This could change with the dry weather in WA, SA and even parts of VIC.

Ocean Freight & Shipment Stem Update:

The recent positive sentiment spruiked by owners have now translated into physical gains in the ocean freight market. The Panamax sector was well supported by more cargo and shrinking tonnage lists in the Atlantic, and the Pacific was underpinned by fresh cargo ex Australia and Indonesia. The Atlantic saw sustained interest from the US Gulf and healthy demand from the Continent and Mediterranean, while the South Atlantic saw reasonable levels of fresh enquiry. A steady supply of Indonesian coal demand helped maintain rates from South Asia, while further north, brokers spoke of a healthy volume of NoPac and backhaul business.

The Ultra/Supra market in the Pacific has now jumped back up to 17/18k. Handies in the Pacific found a new sense momentum off the back of more demand appearing from Aussie and NZ as the cargo-to-tonnage balance changed in the owner's favour.

The recent Iran/Israel conflict has yet to deliver any material changes in the shipping market. Most people are now anticipating minimal (if any) new impacts if the situation remains "as is" given the major disruption has already occurred (ie vsl's avoiding the Red Sea/Suez transit).

It’s been a quiet week for shipping stem additions. There was 200 thousand metric tonne (KMT) of wheat added to the stem in the past week. Canola additions were strong at 245KMT.

USDA Summary:

Australian Weather:

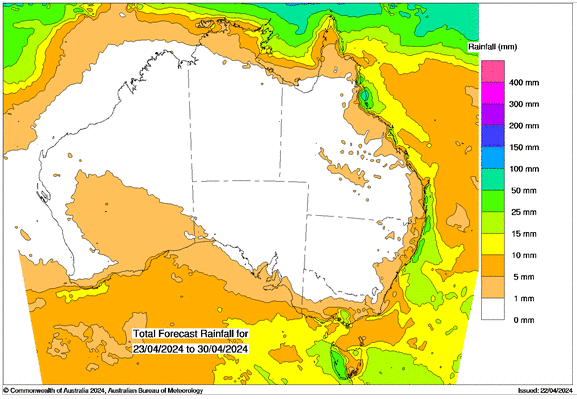

WA and SA are still waiting for an autumn break in the weather. VIC has seen some light showers in early April, however it wouldn’t be described as a break to the season. This triggered early crop plantings, but the moisture quickly disappeared as most areas hadn’t seen any significant rain for 2-2.5 months. WA and SA farmers have also started dry planting crops in expectation of a break during May.

8 day forecast to 30th April 2024

Source: http://www.bom.gov.au/

Weekly Rainfall to 22nd April 2024

Source: http://www.bom.gov.au/

AUD/USD Currency Update:

The Australian dollar was weaker to end last week when valued against the USD closing trade at 0.6411. The AUD fell on Friday below 0.6400 as riskier assets faced pressure due to heightened geopolitical risk across financial markets. Last week on the local front, Australia's unemployment rate rose slightly to 3.8 per cent after 6600 jobs were lost in March, a stronger-than-expected result that will likely end any chance of a mid-year interest rate cut.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.