Australian Crop Update

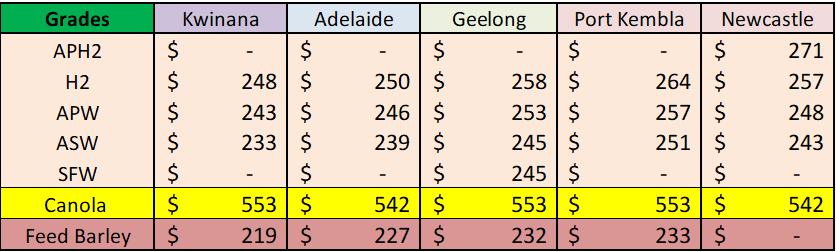

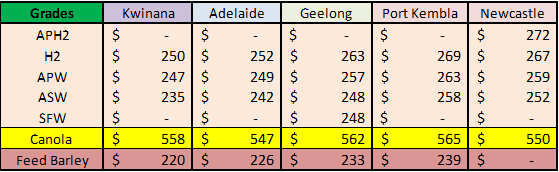

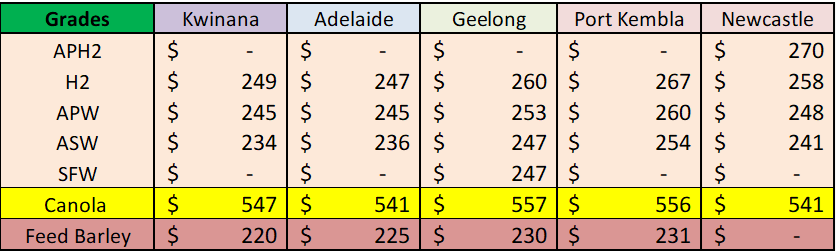

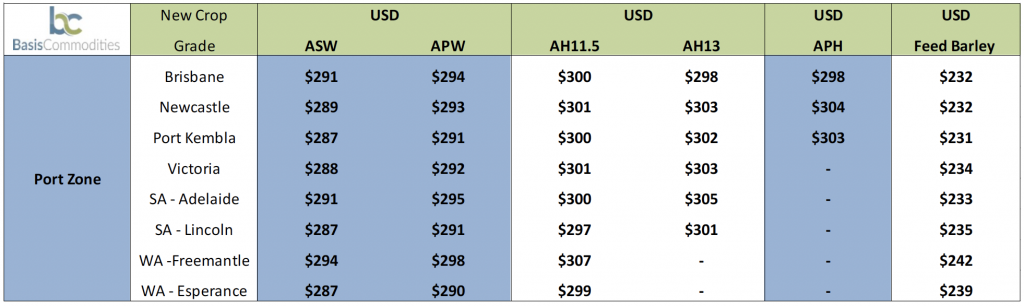

FOB replacement values using Australian track bid/offer – not an indication.

Sellers started to emerge last week with the weakness in US wheat futures and the favourable local crop outlook – The stronger Aussie dollar also weighed on exporter bids. It’s very early days in terms of farmer selling for the 21/22 crop but we are hearing reports of new crop farmer wheat selling in Queensland and Northern New South Wales. Southern farmers still appear more reluctant to let go of new crop tonnes.

ABARES said it now expects Australian wheat production for 21/22 to total 32.63 Mt, up from its June estimate of 27.8 Mt. ABARES said barley production would hit 12.5 Mt this year, up from a June estimate of 10.4 Mt. Australian growers are expected to harvest a record 5.03 Mt of canola. Our Analyst numbers are still running a little behind at 31.0 Mt with the avoidance of significant frost damage and finishing rains needed in some areas. The situation for rain is becoming more important for WA following the drier than normal August. Day time temperatures have been mild, but they will climb this week with high 20’s and up to 30 C in the Geraldton zone.

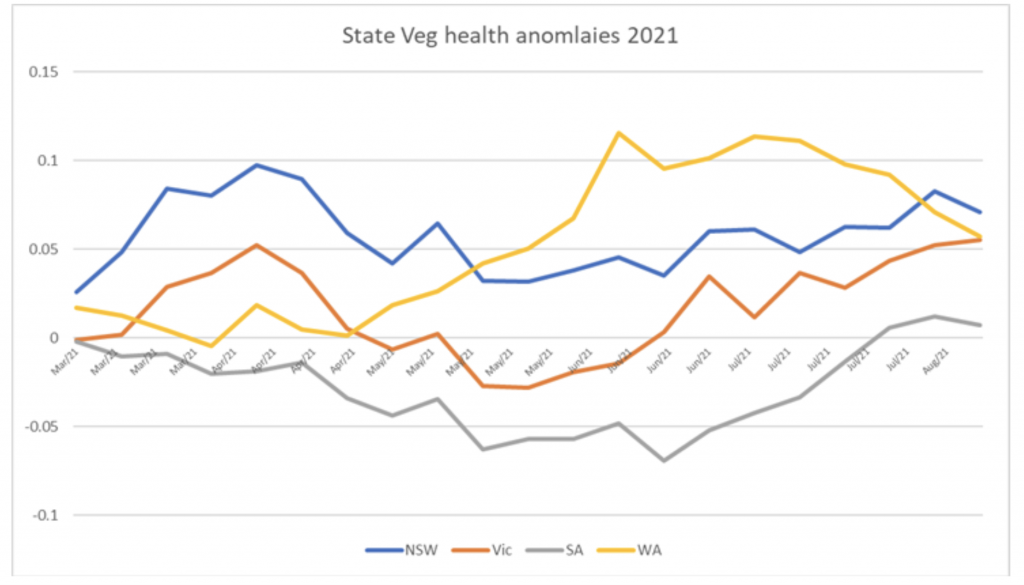

Crops are big and moisture demands are quickly climbing with the warmer temps. Below is a veg index anomaly map with the state cropping zone averages. they need more rain to finish crops.

Australia exported 1.95 Mt of wheat in July down from 2.76 Mt in June. Total wheat exports for Oct/Jul are up to 20.38 Mt. This includes 7.9 Mt from WA, 4.68 Mt from NSW, 3.6 Mt from SA, 2.95 Mt from Vic and 1.19 Mt from Qld.

Some of the heat came out of the pulse markets over the past week with the new crop lentils prices tumbling by $100/t plus. Nonetheless, they remain very strong at more than $1,000/t Melbourne.

Overseas we had a relatively benign, bearish even, USDA report. The Australian crop was raised to 31.5 Mt vs 30 Mt in August with exports up 1 to 23 Mt and Canadian production down 1 Mt to 23 Mt. The next report might be different for wheat when further acreage cuts are expected in spring wheat, and we find out how much wheat was fed when corn was rallying away from feeding in the US earlier this year. Another week and another hike in the Russian tax, this week it was up $6, but although demand is hesitant, it is still there.

To receive this information directly to your inbox as soon as it’s released, sign up for our newsletter below.

The post Australian Crop Update appeared first on Basis Commodities.

Share This Article

Other articles you may like

Sign Up

Enter your email address below to sign up to the Basis Commodities newsletter.